It is a real blow when you see the National Insurance deducted from your pay packet each month isn’t it? Nevertheless, if you are employed or self-employed, are age 16 or over and earning above the minimum threshold, there is no way to evade paying it! After all, it’s in your best interests to make National Insurance contributions as they can help to build your entitlement to certain benefits depending on whether you are employed or self-employed, such as the State Pension and Maternity Allowance.

However, it is not a one size fits all payment and several factors can determine how much, and the type of national insurance contribution is payable including your employment status, age, how much you earn and your residential status. In this blog, we take a closer look at how much National Insurance you are expected to pay based on your personal circumstances.

First things first. We need to discuss pay class. When trying to work out how much National Insurance you will pay you will need to know which class you fall into, this is because how much you pay will depend on your employment status.

The four main classes of National Insurance:

- Class 1 national insurance is paid by employees AND employers (employees earning more than £184 a week and under State Pension age and NI will be automatically deducted by your employer)

- Class 2 is paid if you are self-employed and earning profits of £6,515 or more a year (if you are earning more than this, you can choose to pay voluntary contributions to fill or avoid gaps in your National Insurance record).

- Class 3 is a voluntary contribution. As mentioned above, you can pay voluntary contributions to fill or avoid gaps in your National Insurance record. For example, you may want to voluntary contribute if you’re close to State Pension age and do not have enough qualifying years to get the full State Pension, or maybe you know you will not be able to get the qualifying years you need to get the full State Pension during your working life so decide to voluntarily contribute to help fill the pay gap when you retire.

- Class 4 is paid if you are self-employed and have profits over a certain amount (£9,569 or more a year).

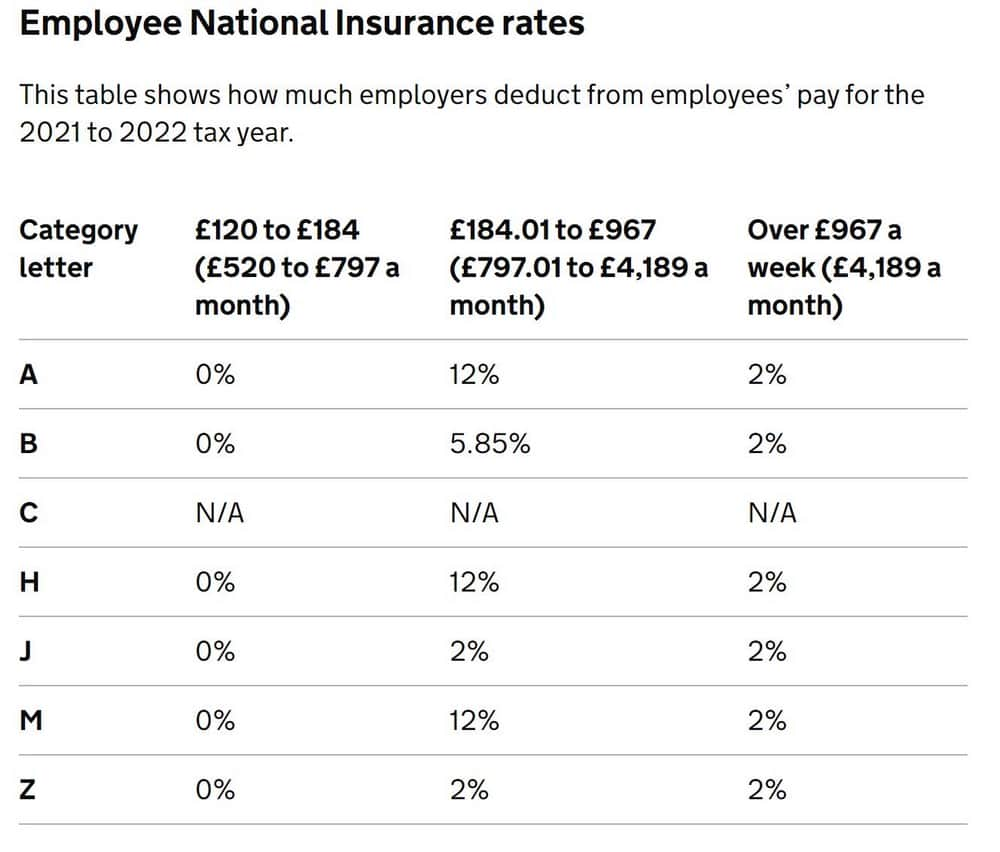

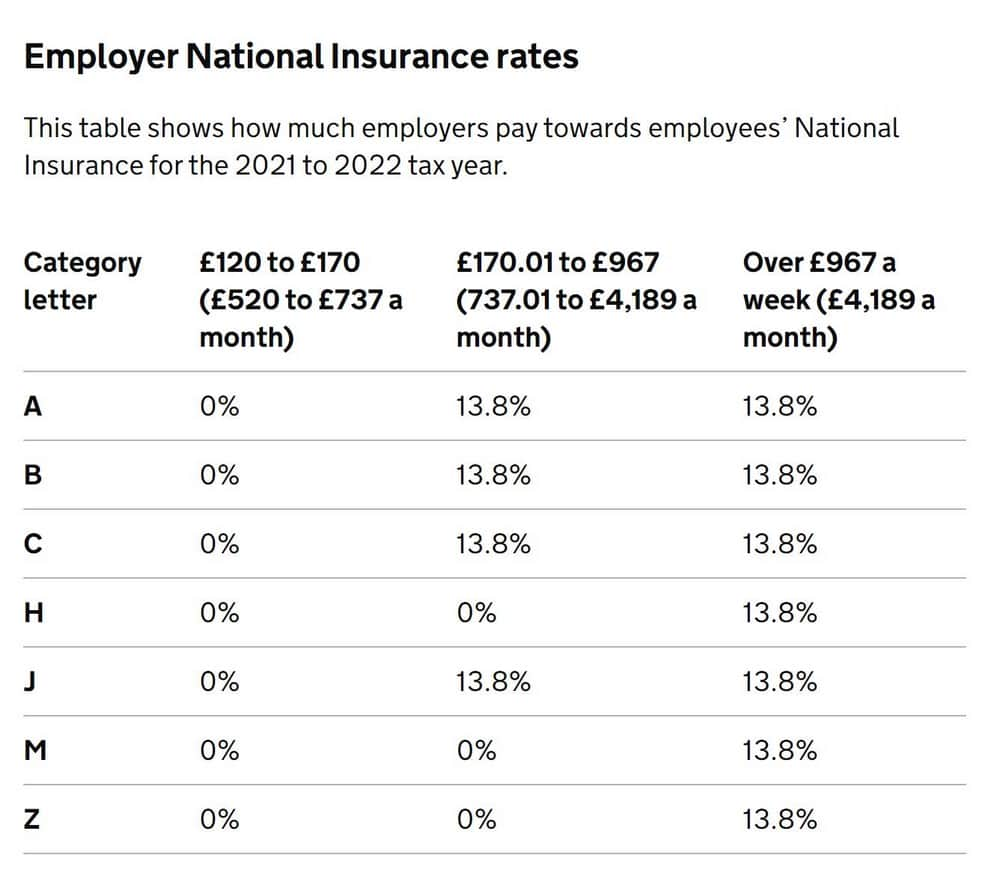

Class 1 National Insurance rates

An employees Class 1 National Insurance is made up of contributions:

- taken from their pay (employee’s National Insurance)

- paid by their employer (employer’s National Insurance)

The amounts deducted and paid depend on:

- the employee’s National Insurance category letter – find out what insurance category letter you are here

- how much of the employee’s earnings falls within each band

Source: gov.uk

If you are an employee, you start paying National Insurance when you earn more than £184 a week (2021/22). As you can see from the table above published by gov.uk the National Insurance rate you pay depends on how much you earn, and is made up of:

- 12% of your weekly earnings between £184 and £967 (2021/22)

- 2% of your weekly earnings above £987.

(N.B. From 6th April 2022, Class 1 NICs will increase temporarily by 1.25% to fund Health and Social Care costs and deal with NHS back logs).

For example, if you earn £1,000 a week, you pay:

- nothing on the first £184

- 12% (£93.96 on the next £783

- 2% (0.66) on the next £33.

Source: gov.uk

Class 2 National Insurance rates

If you are self-employed, you might be able to pay Class 2 contributions instead. Class 2 National Insurance contributions are set at a flat-rate weekly contributions of £3.05 a week in 2020-21 and 2021-22. You will need to pay them for every week or partial week of self-employment in a tax year. This is if your profits for the year are £6,515 or more. If you earn less than this in a year, then you can choose to pay voluntary contributions which can help build contributory entitlements to benefits.

This can be a tricky area so seeking the services of an accountant to do your books or help with your tax return will be invaluable to obtaining guidance on this subject.

Class 3 National Insurance rates

In 2021-22, Class 3 voluntary National Insurance contributions are payable at a weekly rate of £15.40. This is the maximum you can pay each week. You might not always be able to pay Class 3 contributions for a tax year so again, it is important to seek some advice.

Voluntary contributions are there to help fill any gaps in your National Insurance record with the aim of obtaining yourself a higher pension from the state. To receive a full new State Pension, you will need a minimum of 35 qualifying years of National Insurance contributions under your belt. Anyone with less than this will receive a reduced State Pension (at least ten qualifying years needed). If you fall short on qualifying years, paying Class 3 voluntary contributions can boost your pension entitlement.

Class 4 National Insurance rates

If you are self-employed with a profit of £9,500 in 2021-2022, you will pay Class 4 National Insurance contributions. If you are over this figure, you will pay 9% on profits between £9,556 and £50,000 in 2020-21.

Hopefully, this will give you a basic understanding. If you need further help or clarification the team at Bells would be delighted to help. We pride ourselves on our jargon free approach and take pleasure in doing all the hard work for you.