Please read all information thoroughly provided by HMRC while going through this guide to ensure you understand what is required.

Please see the following link for a furlough calculator:

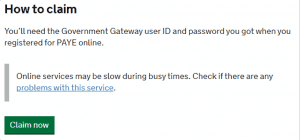

1. Go to the following link and select ‘claim now’

https://www.gov.uk/guidance/claim-for-wages-through-the-coronavirus-job-retention-scheme

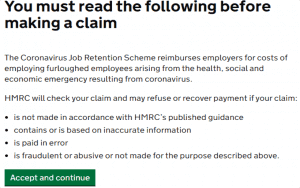

2. Select ‘accept and continue’

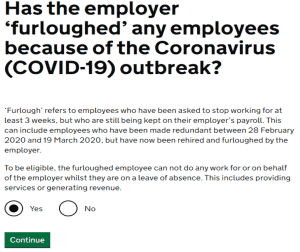

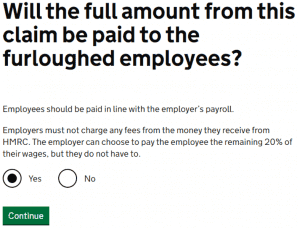

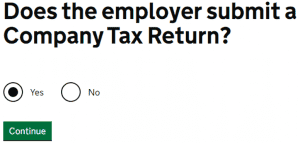

3. Select the option that applies

4. Select the option that applies

5. Select the option that applies

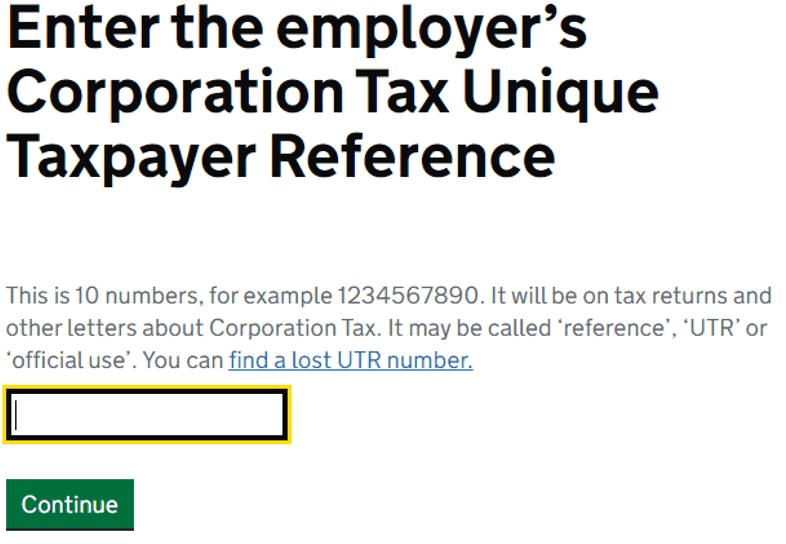

6. Enter the UTR, please contact us if you are unsure of you company’s UTR

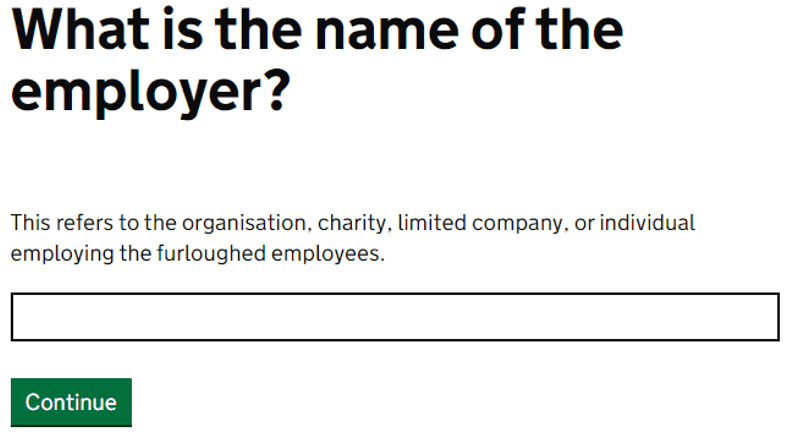

7. Input the registered company name

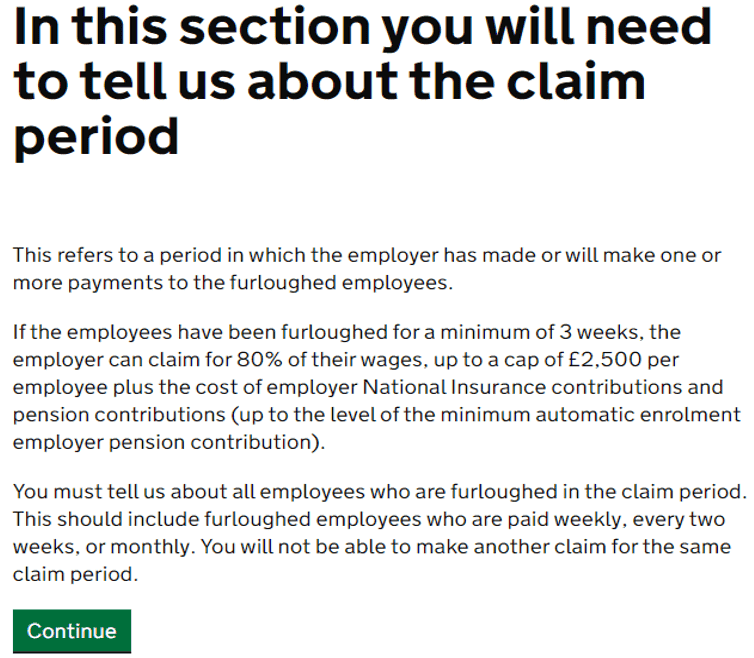

8. Read the details and continue

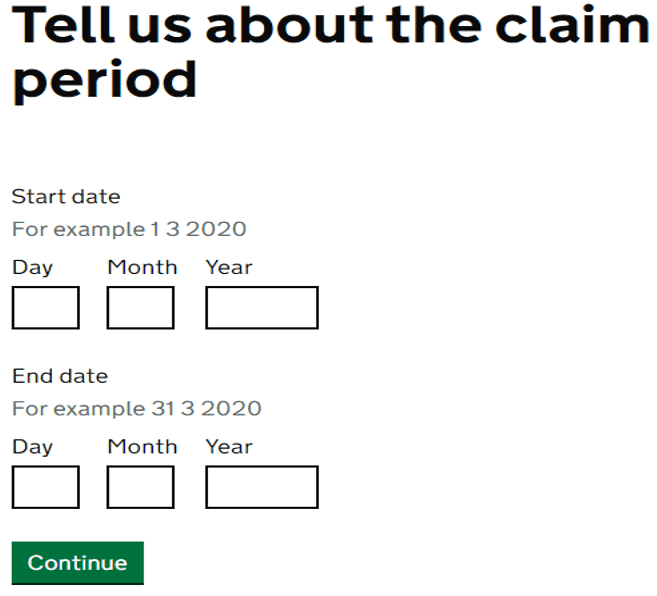

9. Input the period of the claim you are making, usually a calendar month

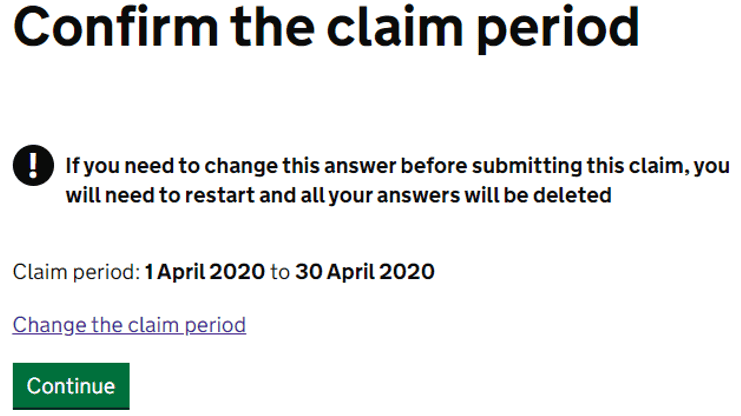

10. Check and confirm the claim period

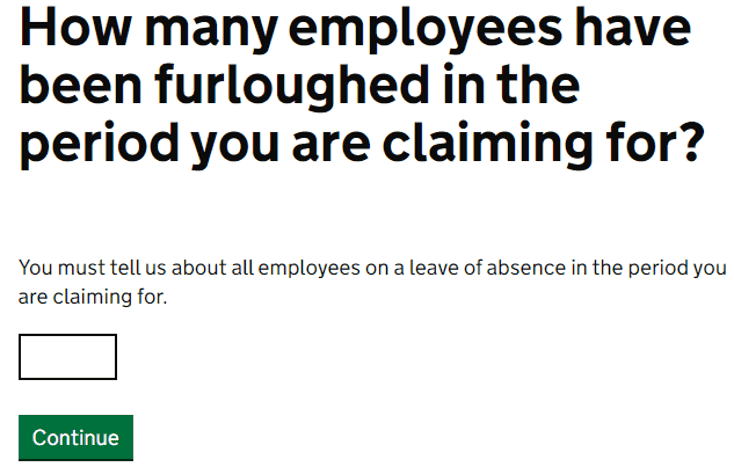

11. Input the number of employees that have been furloughed and you are making a claim for

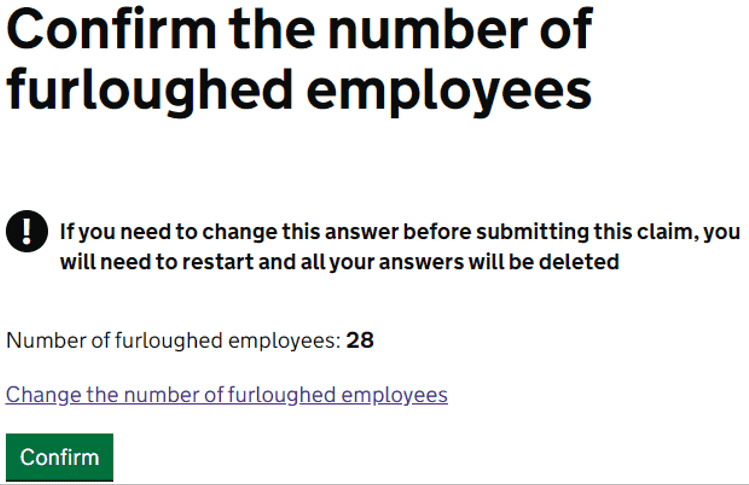

12. Check and confirm the number of employees

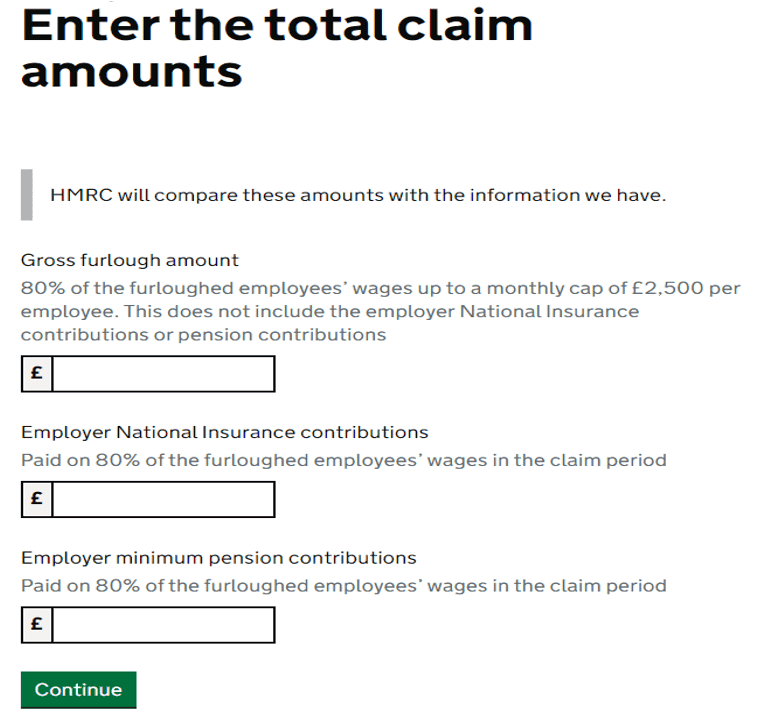

13. Enter the total claim amounts

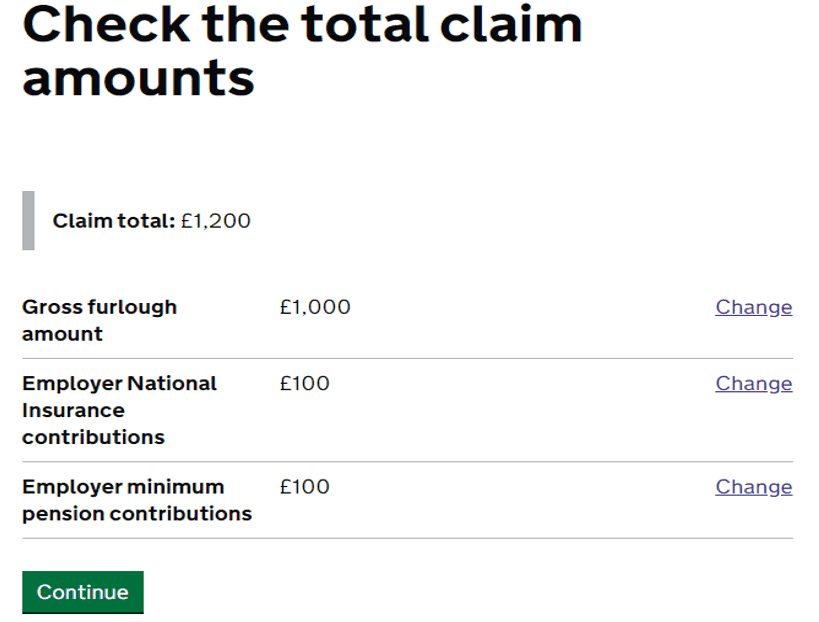

14. Check and confirm the amounts

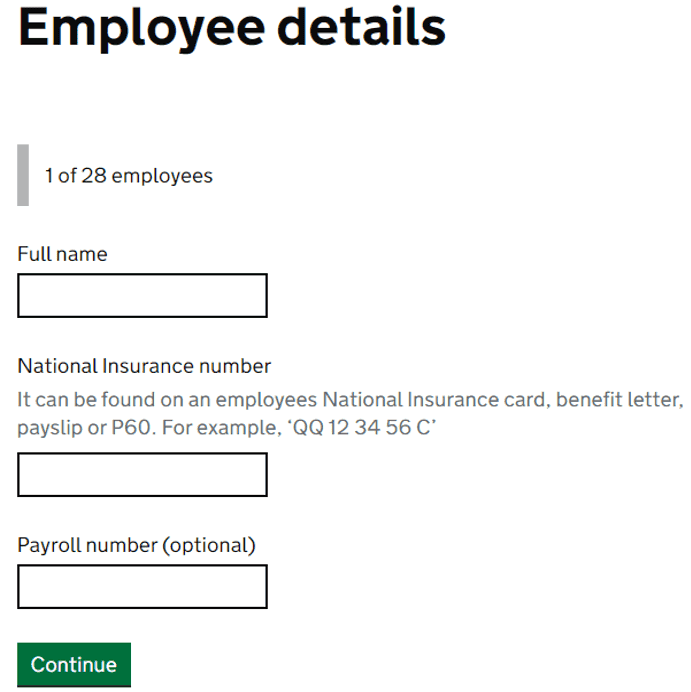

15. Input each employees details you are making a claim for

16. Review and check individuals detail then continue

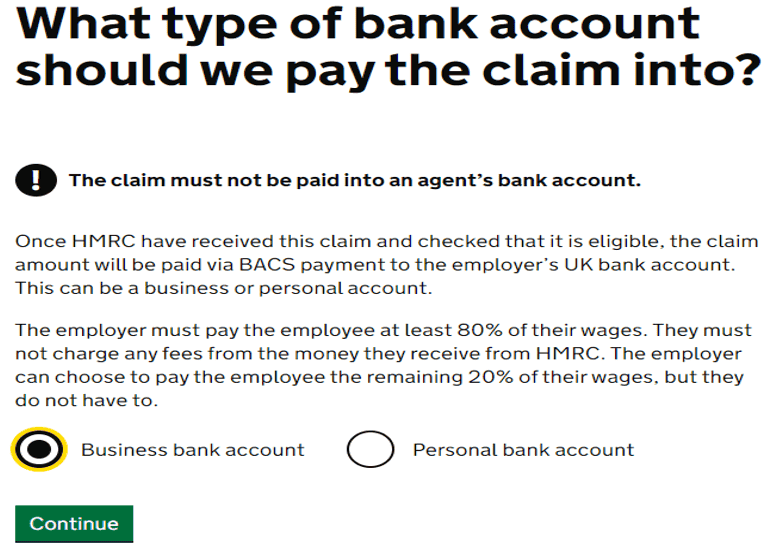

17. Confirm the type of bank account the claim should be paid into

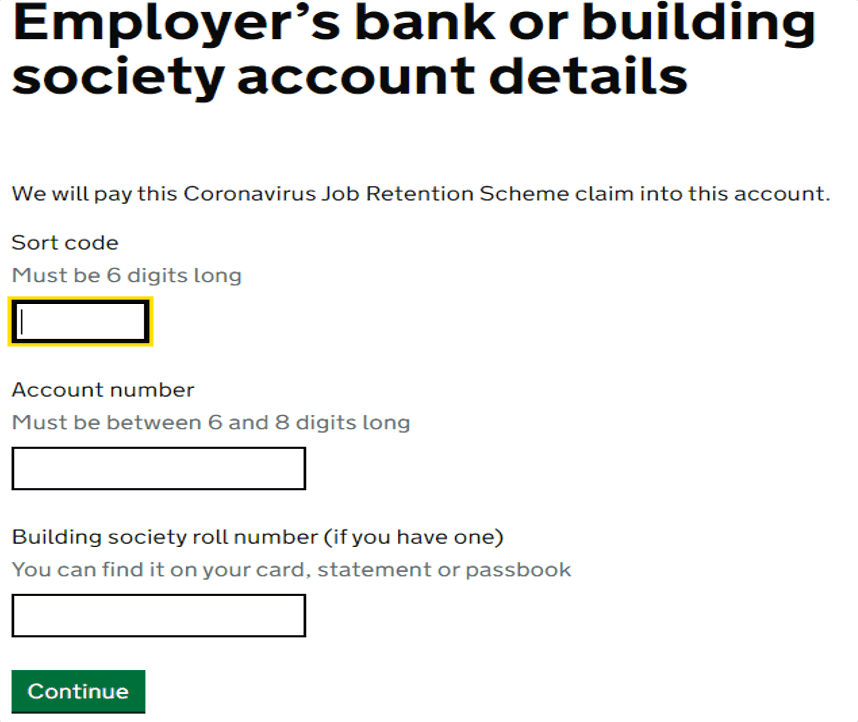

18. Input the bank details the claim should be paid to

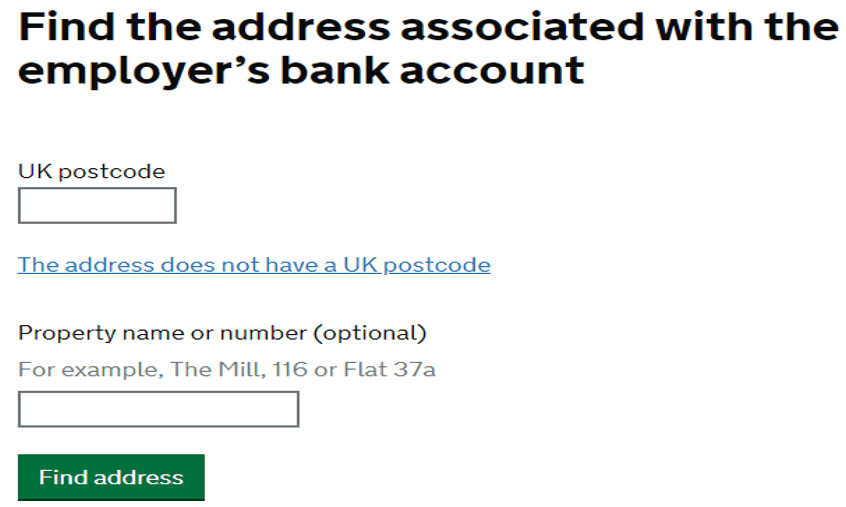

19. Input the address of the bank account (should be the same as the address bank statements are sent to)

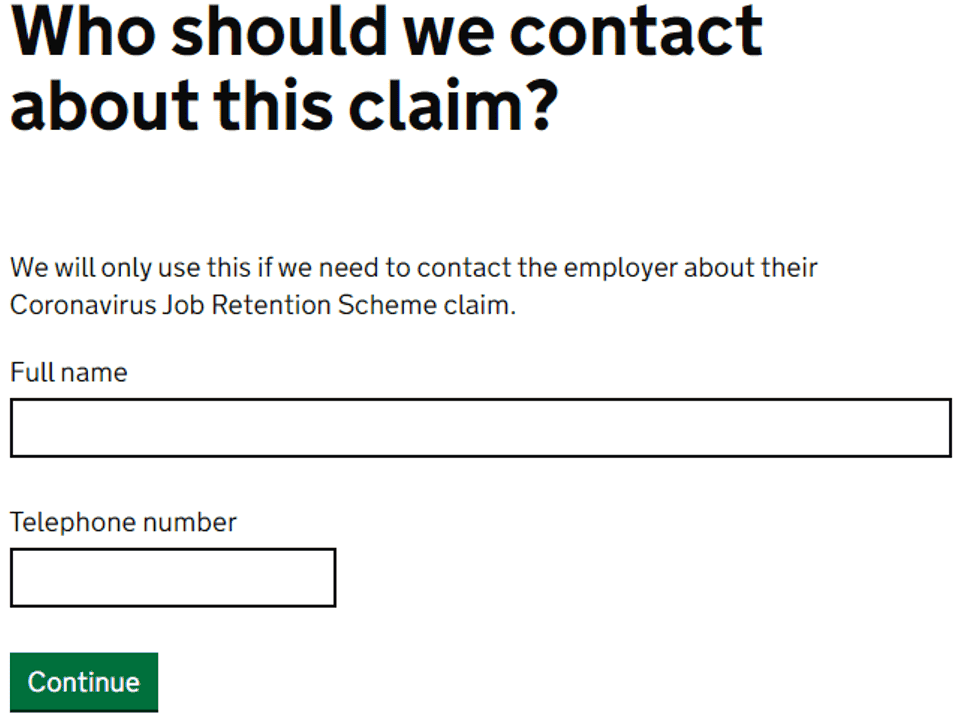

20. Input your details so HMRC know who to contact if they need to discuss the claim further